By Carrie Courtillet

Sep 16, 2022September 16, 2022 – NFM Lending announced that 15 loan originators in its Family of Lenders have been included in the National Association of Minority Mortgage Bankers of America’s (NAMMBA) Top 100 list for 2022. This annual award recognizes 100 loan originators who have had the highest sales volume, units sold, and collateralized loan obligations (CLO) within the previous financial year. Eligible entrants must identify as women or minorities, be actively originating, and have their sales numbers certified by their sales manager. The list of winners was revealed at NAMMBA’s Connect 2022 conference in Orlando, FL. Established in 2016, NAMMBA seeks to empower women and minorities in the real estate and mortgage sectors through training, mentorship, and networking opportunities. The organization also advocates for equitable housing and sustainable homeownership for underserved communities. By bolstering industry professionals and investment in local neighborhoods, NAMMBA affects change at all levels of real estate.

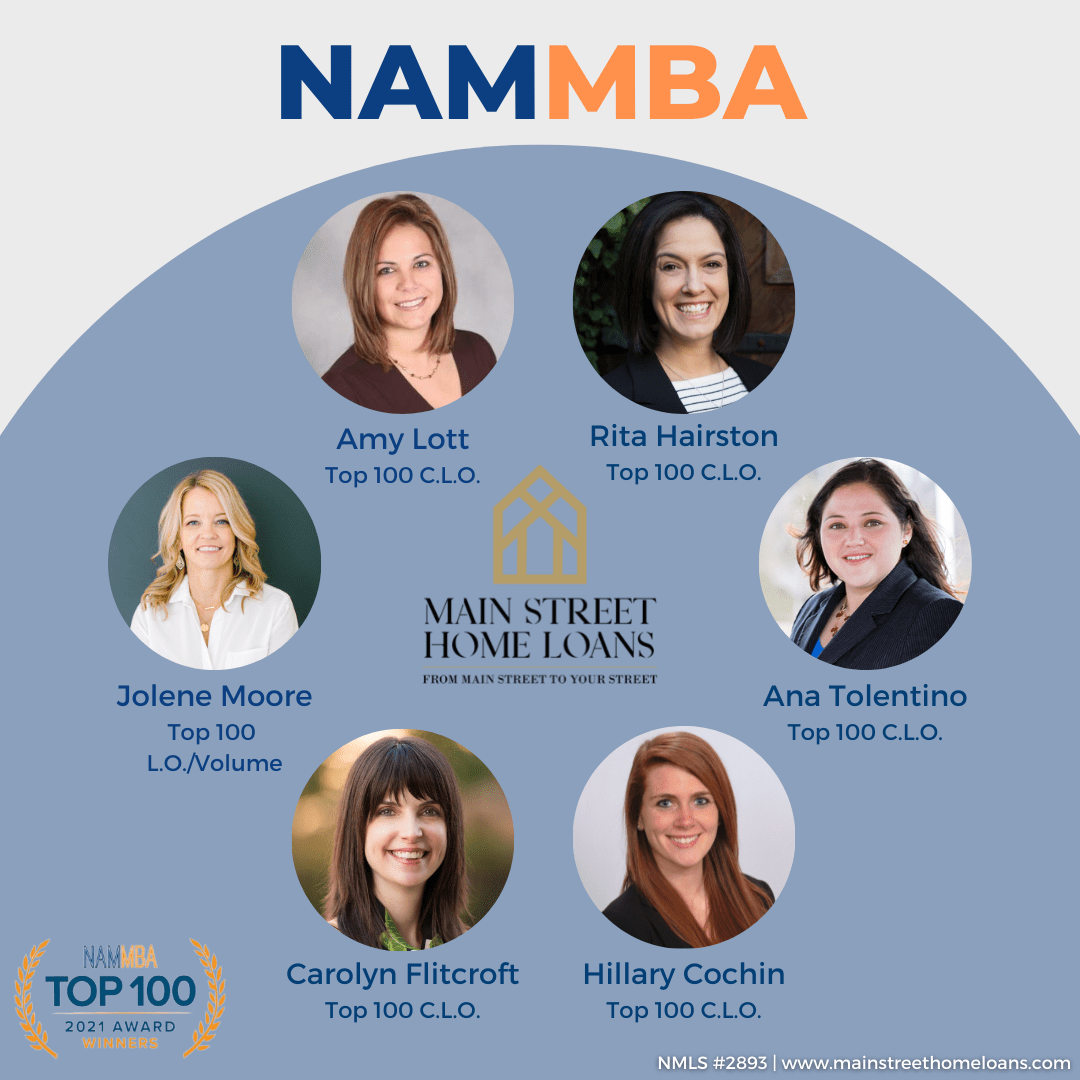

Top Originators at Main Street include:

Volume

Jolene Moore, Main Street Home Loans

CLO

Hillary Cochin, Main Street Home Loans

Carolyn Flitcroft, Main Street Home Loans

Rita Hairston, Main Street Home Loans

Amy Lott, Main Street Home Loans

Ana Tolentino, Main Street Home Loans

Congratulations to our loan originators recognized by NAMMBA as some of the top salespeople in the country,” said NFM Lending President Jan Ozga. “The truth is that we work with them every day and, we already know they are superstars in both origination volume and simply as great people; it’s wonderful that others get to see that, as well. It’s an honor to work alongside all of them.”

Main Street is so proud of these Loan Originators’ achievements and wishes them continued success!

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.