A Home Summer Shape Up Amid Coronavirus Concerns

Here are a few ways to give your home a check up this Summer, despite all the impacts of COVID-19

We hope you to stay safe and be prepared for the months ahead!

Congratulations to the NFM Family! We were awarded the #1 Top Mortgage Originators in the state of Maryland by the Scotsman Guide, 2019. This is a HUGE accomplishment for all our teams and we’re so proud to be a part of this incredibly talented family! Stay Tuned for more amazing things to come in 2020.

Main Street Home Loans is pleased to announce the opening of a new branch in Dover, DE. Located at 146 S. State Street, Dover DE 19901, and led by Vice President and Regional Manager, Devin Wiley. The new branch will focus on expanding Main Street Home Loans friendly and powerful lending platform to better serve all communities with exceptional customer service. Offering Conventional, FHA, VA , USDA, FNMA, Jumbo and many other loan options to fit every borrower’s need, we’re excited to further grow our Main Street family.

Wiley is currently seeing qualified Home Loan Consultants, processors, & underwriters for full and part-time positions.

For more information, please contact:

Devin Wiley

Vice President, Regional Manager

302-363-2128

DWiley@mainstreethl.com

About Main Street Home Loans

Founded in 2019, Main Street Home Loans was built on the philosophy that “One size does NOT fit all.” Especially when it comes to your home. We take a very consultative approach with every client to ensure that this new mortgage fits within their short- and long-term financial goals. Each of our Home Loan Consultants understand the importance of this major financial decision and are trained to help our clients navigate through the countless home loan products in order to place them in the home loan that’s right for them. We are honored to be with you on your journey from Main Street to Your Street. For more information visit www.mainstreethomeloans.com, like our Facebook page and follow us on Instagram

One of the goals of the recently passed CARES Act (Coronavirus Aid, Relief, and Economic Security Act) is to provide relief for struggling homeowners, including the requirement that loan servicers provide mortgage forbearance. It’s important to understand what this forbearance means and who is able to take advantage of the relief.

What is Mortgage Forbearance:

Forbearance is when your mortgage servicer or lender allows you to pause (suspend), or reduce your mortgage payments for a limited period of time while you regain your financial footing. It is NOT mortgage forgiveness nor does it forgive what you owe. It is basically a temporary period where mortgage payments will not be due monthly, to provide some immediate relief for those who need it. According to the CARES Act, loans will accrue interest during forbearance, but many will not be subject to additional interest or fees. At the end of forbearance, some loan servicers may request multiple months’ worth of payments due at one time, so it’s highly recommended that you contact your loan servicer to learn and understand their repayment terms. *the servicer contact information is located on your monthly mortgage statement*

Who is eligible for mortgage forbearance:

Qualification requirements for mortgage forbearance vary by lender, but generally you’ll start by submitting an application. Various lenders may allow you to start the application online, while others will ask that you call them first. Upon starting the application process, you’ll want to have a few items on hand:

It’s best to start the process early rather than waiting until you’re about to miss a payment. Also, it is recommend that if you can make your mortgage payments, to keep paying them. Do not contact your servicer if you’re aren’t facing immediate financial hardship.

To learn more, check out this short, highly informational VIDEO from the Consumer Financial Protection Bureau, which explains forbearance and how to navigate the best options for you.

Any questions, feel free to reach out to one of our Home Loan Consultants, and we suggest that it is always a good idea to consult with your financial advisor or tax consultant before making financial decisions.

May is National Moving Month! Are you on the move? Check out these tips to make life a little easier!

Main Street salutes (Ret.) Major Jeremy Haynes. Watch and learn more about his amazing story of bravery.

Mortgage calculators are a vital tool for any prospective homebuyer as well as current homeowners. They help to estimate your monthly mortgage payments as well as determine how much you can afford when purchasing a home. There are a variety of mortgage calculators available, but Main Street Home Loans offers three free options: The Mortgage Payment Calculator, An Affordable House Calculator, and A Refinance Calculator. Let’s explain how they work:

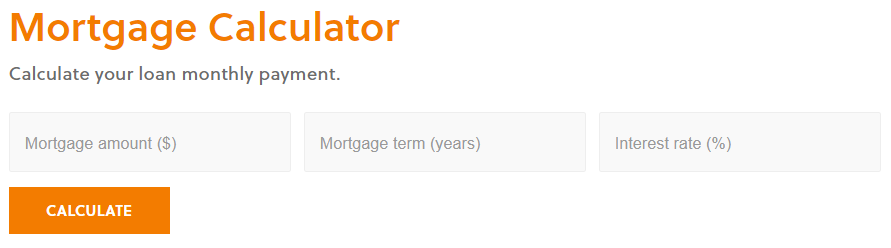

The Mortgage Payment Calculator

For a quick estimate of a monthly mortgage payment, this calculator is ideal. Input your total mortgage, the mortgage term (years), and the interest rate. A monthly payment estimate (principle and interest) will generate based on those figures.

Example, if the total mortgage is $450,000 for a Conventional 30-year loan with a 4% interest rate, the principle and interest monthly payment would be $2,148.37 (this does not include taxes, homeowners insurance or any applicable Homeowners Association dues).

Affordable House Calculator

If you’re interested in purchasing a new home, the affordable house calculator should be the first one you use. Prior to starting the homebuying process, it’s important to determine how much you can afford to spend on any particular home. To use this calculator you’ll need a few pieces of information: 1. Your monthly income: wages, bonus or commission income, dividends, etc., 2. Details on the property you are interested in including, down payment amount, mortgage term in years, interest rate, annual homeowner’s insurance, and annual real estate taxes (these are specific to County, City and State) 3. Lastly, any other monthly expenses should be entered such as alimony, monthly car payments, credit card payments and student loan debt.

With this information, this calculator helps to provide a suggested new home value, loan amount, and monthly payment so you have a better understanding of how much you can afford to spend.

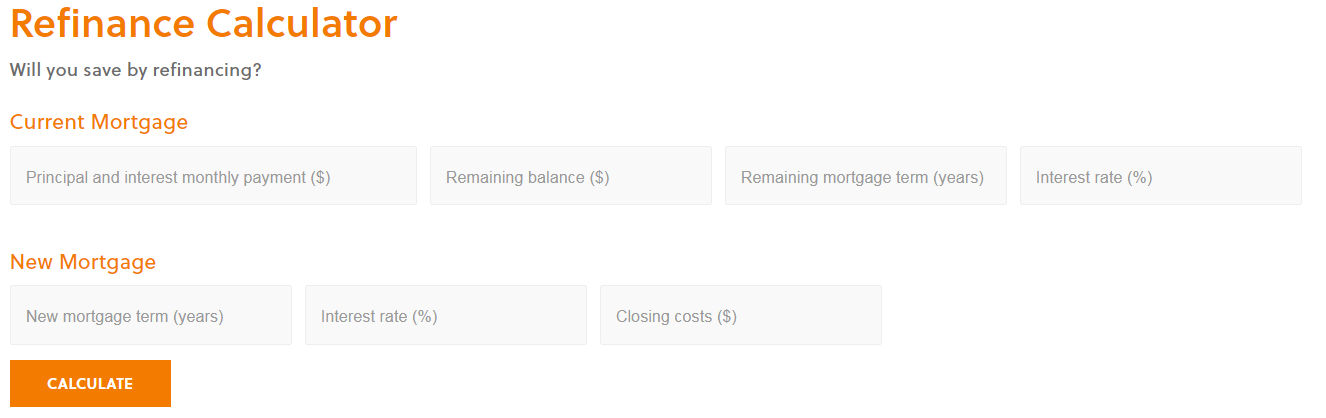

Refinance Calculator

Are you interested in refinancing your mortgage? The refinance calculator helps determine how much money you could save by doing so. You’ll simply need details on your current mortgage including, the principal and interest monthly payment, remaining balance on the current loan, remaining mortgage term in years, and interest rate. Next, enter details for the new mortgage: updated mortgage term (in years), interest rate, and closing costs. The calculator will generate an estimated new monthly payment, in addition to monthly savings, interest savings, closing costs, and the amount of time it will take to recoup your costs.

These calculators are available for your convenience, and you can email yourself the results of any scenario you design. Keep in mind: the figures input on these calculators are merely estimates, not 100% accurate.

Want to learn more?! Contact one of our licensed Home Loan Consultants. And if you are ready to begin the home buying or refinancing process, click here to get started!

Are you a city-slicker looking for a change of scenery? Lucky for you, the United States Department of Agriculture (USDA) created a home loan that is meant for people who are looking to live further off the grid. Let us introduce you to USDA loans and what you need to know about them.

First of all, USDA home loans are NOT for farmers. This program might hold that preconception, however, this loan is available to anyone looking for a residential property in an eligible rural or suburban area. The USDA’s definition of rural is pretty broad, so make sure to check their property eligibility maps to see if the area you’re interested in meets their definition.

• No down payment

– You read that right. USDA loans allow buyers to finance a home for up to 100%* of the price so there is no down payment requirement.

• Lower credit scores are acceptable

– Don’t worry if you have less-than-perfect credit. Scores of 640 and higher will have faster processing, while 640 and below might face more strict underwriting standards.

• No loan limits

– The USDA does not have loan limits in place. That means your purchasing power may be higher than it would be with another loan program. Your lender will be able to help you determine how much you qualify for.

• Multiple property types

– Eligible property types include existing, new construction, condos, town homes, manufactured**, modular, and short sales or foreclosed homes.

Most other requirements for a USDA loan are very flexible, including credit and employment history.

Are you’re ready to leave the city behind? A USDA loan may be right for you! If you have questions about buying a home with a USDA loan, contact one of our licensed Mortgage Loan Originators. If you are ready to begin the home buying process, click here to get started!

*100% financing, no down payment is required. The loan amount may not exceed 100% of the appraised value, plus the guarantee fee may be included. **Only new manufactured homes are permitted, and they must come from eligible dealerships.