By Carrie Courtillet

Dec 2, 2019Mortgage calculators are a vital tool for any prospective homebuyer as well as current homeowners. They help to estimate your monthly mortgage payments as well as determine how much you can afford when purchasing a home. There are a variety of mortgage calculators available, but Main Street Home Loans offers three free options: The Mortgage Payment Calculator, An Affordable House Calculator, and A Refinance Calculator. Let’s explain how they work:

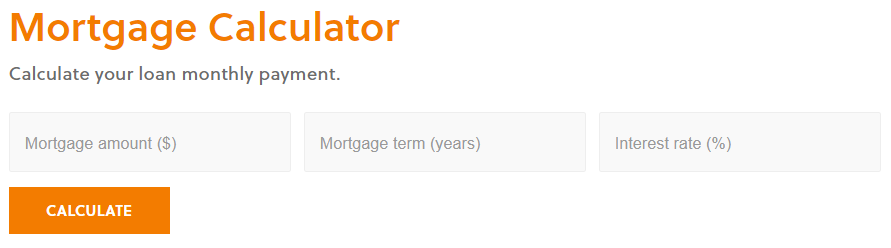

The Mortgage Payment Calculator

For a quick estimate of a monthly mortgage payment, this calculator is ideal. Input your total mortgage, the mortgage term (years), and the interest rate. A monthly payment estimate (principle and interest) will generate based on those figures.

Example, if the total mortgage is $450,000 for a Conventional 30-year loan with a 4% interest rate, the principle and interest monthly payment would be $2,148.37 (this does not include taxes, homeowners insurance or any applicable Homeowners Association dues).

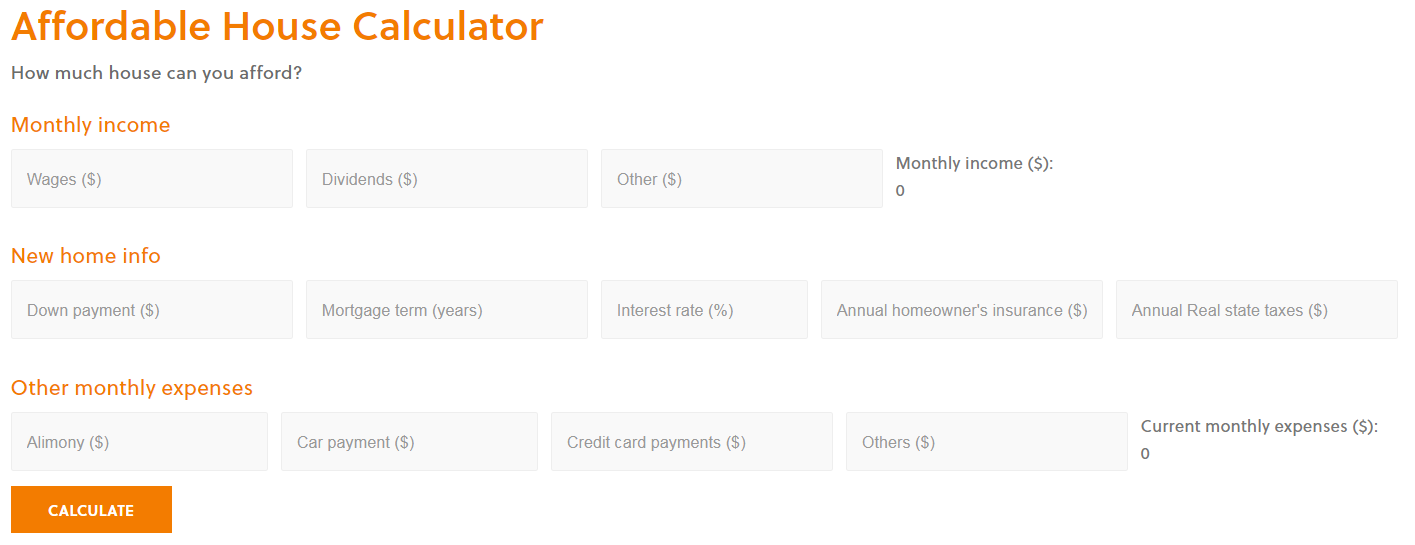

Affordable House Calculator

If you’re interested in purchasing a new home, the affordable house calculator should be the first one you use. Prior to starting the homebuying process, it’s important to determine how much you can afford to spend on any particular home. To use this calculator you’ll need a few pieces of information: 1. Your monthly income: wages, bonus or commission income, dividends, etc., 2. Details on the property you are interested in including, down payment amount, mortgage term in years, interest rate, annual homeowner’s insurance, and annual real estate taxes (these are specific to County, City and State) 3. Lastly, any other monthly expenses should be entered such as alimony, monthly car payments, credit card payments and student loan debt.

With this information, this calculator helps to provide a suggested new home value, loan amount, and monthly payment so you have a better understanding of how much you can afford to spend.

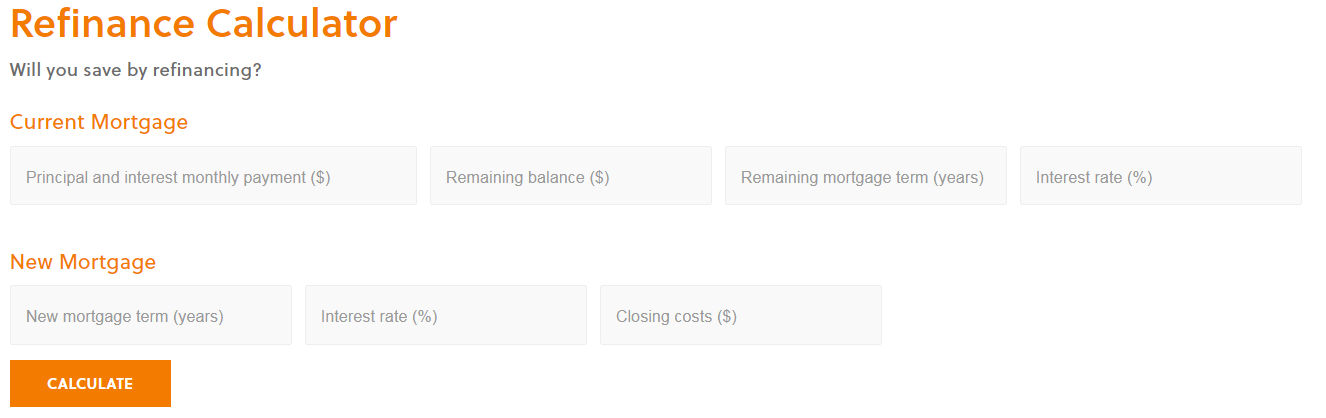

Refinance Calculator

Are you interested in refinancing your mortgage? The refinance calculator helps determine how much money you could save by doing so. You’ll simply need details on your current mortgage including, the principal and interest monthly payment, remaining balance on the current loan, remaining mortgage term in years, and interest rate. Next, enter details for the new mortgage: updated mortgage term (in years), interest rate, and closing costs. The calculator will generate an estimated new monthly payment, in addition to monthly savings, interest savings, closing costs, and the amount of time it will take to recoup your costs.

These calculators are available for your convenience, and you can email yourself the results of any scenario you design. Keep in mind: the figures input on these calculators are merely estimates, not 100% accurate.

Want to learn more?! Contact one of our licensed Home Loan Consultants. And if you are ready to begin the home buying or refinancing process, click here to get started!

These blogs are for informational purposes only. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. Should you have any questions about the information provided, please contact us.